Are your employees making the most of their workplace pension?

Unlocking a dream retirement is the prize for many of your employees that have spent decades working hard and focusing on their careers.

So, it is vital that they have enough savings put away to provide them with a decent income throughout retirement — and their workplace pension is likely to make up the bulk of these funds.

The UK government provides a State Pension that provides a safety net for many individuals, yet it is unlikely to be enough to adequately support your workers’ retirement needs. This makes it very concerning that Unbiased reports 1 in 6 over-55s have no private pension savings set aside.

Read on to learn about the benefits of the workplace pension and how you can use it to boost your employees’ retirement opportunities, which may go a long way to improving their emotional and financial wellbeing.

Current auto-enrolment rules require an 8% workplace pension contribution

If you have any staff aged between 22 and the State Pension Age (SPA), earning at least £10,000 in the 2022/23 tax year, you must offer them a workplace pension scheme.

Under current workplace pension auto-enrolment rules, the minimum pension contribution is 8%. This is made up of a 3% contribution from you as their employer and a 5% employee contribution (including tax relief).

One way you could opt to boost your employees’ savings is to increase your employer contribution to match any increase in their personal contributions. If they opt to contribute more, you might offer to match some or all of these contributions, further increasing their pension pot.

Employees will also receive other great benefits such as tax relief on their pension contributions, which is automatically paid at the basic Income Tax rate of 20% (higher- or additional-rate taxpaying employees can claim additional relief through self-assessment).

The government provides relief on all pension contributions up to the Annual Allowance, which stands at £40,000 (or 100% of earnings if lower) for the 2022/23 tax year.

Working with Aspira to get the most out of your workplace pensions scheme for your employees can go a long way to securing their futures. Additionally, the added value provided to your team could help retain your staff over the long term.

3 ways you can add value to your employees’ workplace pension you may not have considered

1. Help them seek financial advice from an expert at regular intervals to review their pension savings

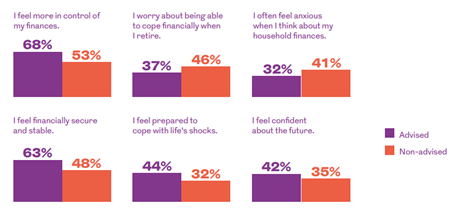

The benefit of financial advice shouldn’t be underestimated both financially and holistically. According to a study by Royal London, individuals receiving financial advice had significantly better wellbeing outcomes than those who didn’t, as shown by the graphic below:

Source: Royal London

The report goes on to state that non-advised individuals are more likely to lack understanding of financial products with more of them not knowing where to begin with their retirement saving plans.

Providing access to financial advice for your employees you can go a long way towards assuaging any ongoing concerns about their retirements and help them get on top of their current plans.

It could have significant benefits to their long-term outlook. The Social Market Foundation reports that, on average, individuals approaching retirement in the UK are almost £250,000 short of the pension pot required to meet their desired retirement goals. The findings include:

- 31% of those surveyed lacked an accurate understanding of how much savings they’ll need for their desired level of retirement comfort

- Only 20% of people with pensions have sought out and received independent regulated financial advice.

Aspira offers a comprehensive workplace pension consultation service and can work with you to ensure all your employees are regularly updated on how they are progressing towards their pension saving goals.

2. Make active decisions about fund choices, rather than letting the provider decide for you

Workplace pensions typically come in two forms: defined contribution (DC) schemes and defined benefit (DB) schemes (also known as “final salary” schemes).

Most workplace pensions are DC schemes. So, there will be plenty of options to that will allow you and your employees to have a say on how their money is invested, rather than simply relying on the provider to decide for them.

There may be a choice of funds aimed at different risk profiles, from low- to high-risk. Additionally, employees may have access to ESG (environment, social, governance) funds that enable them to align their savings with their morals and ethics.

Most people opt to invest their pension in a mix of assets because diversifying their investments helps reduce associated risks and mitigate against potential losses.

There are plenty of active decisions you and your employees can make about their pensions’ fund choices, so receiving advice on the matter could be hugely beneficial.

3. Offer a salary sacrifice option to your team

Under a salary sacrifice arrangement, your employee gives up part of their salary or bonus in exchange for their employer paying the value directly into their pension.

While personal pension payments are typically free from Income Tax, they are usually subject to National Insurance contributions (NICs).

NICs are charged at 12% of your employee’s salary on earnings between £12,570 and £50,270 in the 2022/23 tax year and at 2% (2022/23) for anything earned above the threshold.

As an employer for those earning over £9,100 you are required to pay 13.8% of your employee’s salary (2022/23 tax year) in National Insurance (NI) payments.

However, if a salary sacrifice is used, the pension contributions do not form part of their pay and are free from NI charges.

This benefits both employee and employer as both parties save on NICs.

Get in touch

Aspira offer a complete workplace pensions consulting service, which can help you ensure that your employees receive the best possible retirement planning advice. It can also assist you in developing a desirable benefits package.

Excellent pension benefits could provide a significant boost to your employees’ financial and emotional wellbeing and subsequently increase the productivity and staff retention levels within your business.

For advice on the best next steps and ways to boost your benefits programme, email info@lebc-aspira.com or call us on 0800 048 0150.

Please note

The information contained in this article is based on the opinion of Aspira and does not constitute financial advice or a recommendation to any investment or retirement strategy.

You should seek independent financial advice before embarking on any course of action. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.

Back To List

Submit a comment