The luck of the Irish: 5 key aspects of your financial planning you shouldn't leave to chance

One of the best-known events in the March calendar is St Patrick’s Day.

Everyone with any Irish blood will most likely spend 17 March celebrating their heritage. They’ll also be joined by many others who just like the craic and the taste of Guinness!

The Cheltenham Festival held around the same time also has strong Irish connections. Thousands of racegoers will cross the Irish Sea to make the annual pilgrimage to Gloucestershire and some may confirm the old adage – “the luck of the Irish” – as they make a fortune off of English bookmakers.

According to the Ireland Before You Die website, the origin of that particular expression is derived not from gambling, but from the regular success of Irish prospectors during the gold rush era in the United States and Australia.

As financial advisers, we wouldn’t recommend you basing your financial plans on the chances of digging up gold. However, when it comes to planning your financial future, there are five key aspects you can’t afford to leave to chance.

1. Planning your financial future

You probably wouldn’t consider starting any major project – at work or home – without an initial plan in place. It should be the same with your finances. A financial plan can help you stay on track and will give you a better chance of ultimately achieving your goals than simply trusting to luck.

It doesn’t have to be too complicated at the outset; understanding your financial position is a good place to start. You should note down key financial information such as:

- Your monthly household income and expenditure

- Your savings and investments

- How much you’re currently contributing to pension arrangements.

Once you have those details set out, you can then start looking ahead to see what steps you need to take to help secure your financial future.

2. What happens to your loved ones when you die

They are sad facts of life, but accidents happen and serious illness can strike even the healthiest people at any time.

That’s why you need to ensure you have plans in place to protect your loved ones should the worst happen.

A simple life insurance arrangement, that pays out a lump sum of money when you die, can help protect your family and give you peace of mind that they will be able to manage financially when you pass away.

In addition, both you and your partner or spouse need to make sure you have wills in place.

Dying without a will – or “intestate” – can create endless problems for your family at a time when they’re likely to be upset and potentially unsure of their future plans.

Setting out instructions on how you want your assets to be distributed can help avoid divisive and expensive legal disputes.

3. Your income in retirement

A key part of your financial plan should be ensuring you have the means to enjoy your retirement when you finally decide to stop work.

The life expectancy calculator provided by the Office for National Statistics confirms that a man currently age 50 can expect to live on average to 84, while the equivalent age for a woman is 87.

As you could potentially spend a quarter of your life in retirement, it makes sense to plan ahead and set aside money to fund your retirement. You shouldn’t automatically assume your State Pension will provide you with enough to live on.

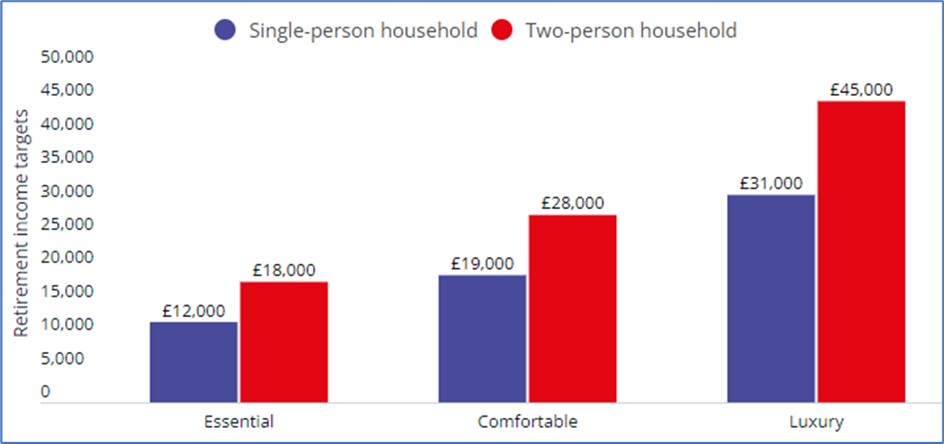

A Which? survey in 2022 revealed the levels of income required to fund different qualities of lifestyle in retirement.

Source: Which?

From April 2023, the maximum annual State Pension will increase by 10.1% to £10,608. The effect of the triple lock means it should go up each year by at least the rate of inflation. As you can see from the chart above, it’s enough to cover most of your essentials, but it’s wise to take proactive steps to ensure you’re able to live a comfortable life in retirement that you’re working hard for now.

Find out more about planning for your retirement

4. Keeping your plans on track

Having a financial plan in place is a big step forward, but you shouldn’t trust to luck and assume everything will take care of itself once you’ve got your initial financial plan set up.

Your circumstances are likely to change. This means that your plans will need to be reviewed regularly to ensure you remain on track to achieve your financial goals – and make changes if needed.

At the very least you should be reviewing your plans annually. While you’re unlikely to need to make any big changes in your 30s and 40s, key life events such as divorce or the birth of children could necessitate you amending your plans.

Although there’s no such thing as a crystal ball, a cashflow forecasting tool can do an effective job of helping you see into the future.

By using existing data and informed projections, it can help you see how your financial position may look at a selected time such as your planned retirement date. It can also help “war game” potential life events such as taking out a bigger mortgage or retiring early.

5. Dealing with an emergency

An emergency or “rainy day” fund is an essential requirement for any household, yet a survey reported by Aviva showed that one in three people have less than £600 in savings. That amount is unlikely to be enough to meet the cost of most common emergencies, such as a broken boiler or leaking roof.

Your emergency fund should ideally amount to between three- and six-months’ of household expenditure. Having such an amount of cash on hand will help you avoid having to rely on short-term borrowing at high rates of interest.

By definition, you may need to access it in an emergency, so you should keep it in an instant-access savings account.

Get in touch

If you need help or advice regarding any of the financial issues you’ve read about here, please get in touch.

Email info@lebc-aspira.com or call us on 01454 632 495.

Please note

The information contained in this article is based on the opinion of Aspira and does not constitute financial advice or a recommendation to any investment or retirement strategy.

You should seek independent financial advice before embarking on any course of action. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Back To List

Submit a comment